Asset Turnover Ratio Standard

The time frame can be adjusted for a shorter or longer time. A high asset turnover ratio indicates that a company.

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

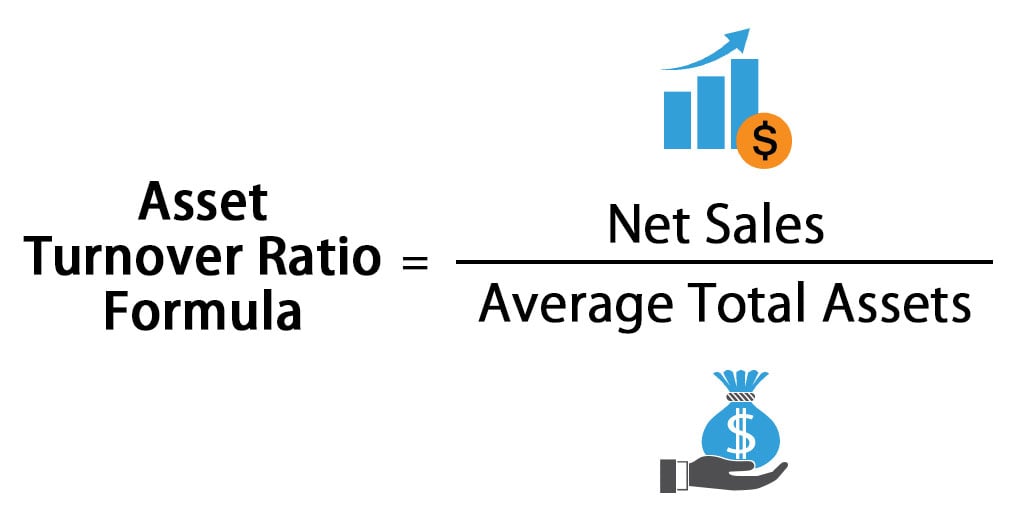

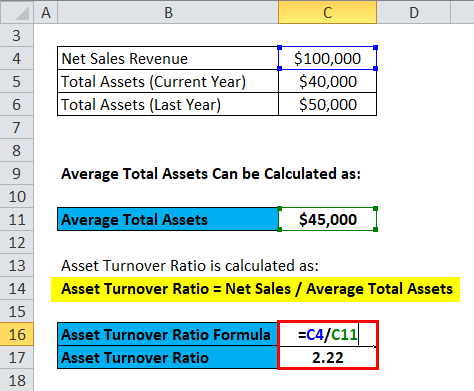

It is calculated by dividing revenue by average total assets.

. Revenue on the other. This is an efficiency ratio. As we dont have detailed data on returns and doubtful debt allowances we can use the average.

Now we have Net Sales 70000. 514405 211909 24 times. The asset turnover ratio is an efficiency ratio that measures and helps analyse a companys ability to generate sales from its assets by comparing net sales with average total.

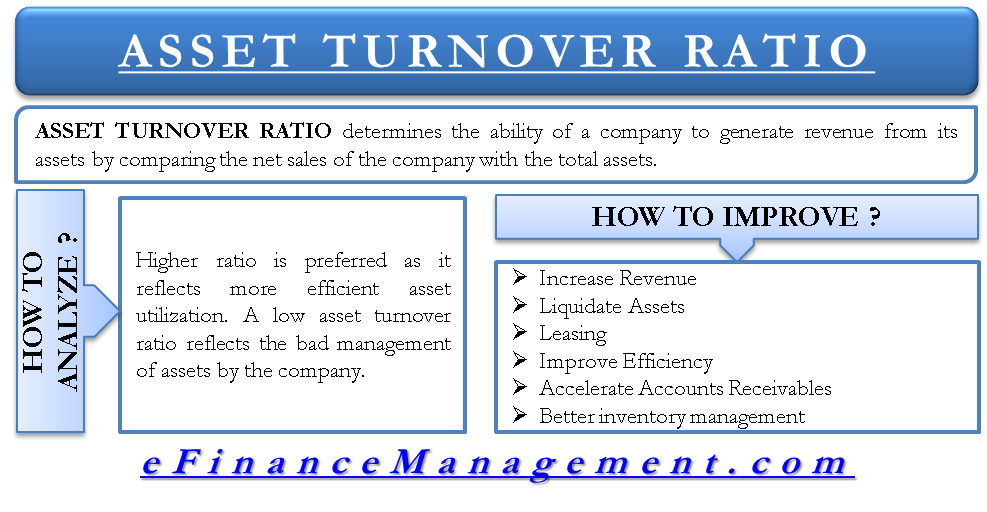

What is Asset Turnover Ratio. Upon doing so we get 20x for. The total asset turnover calculation can be annually per year although it can be calculated otherwise.

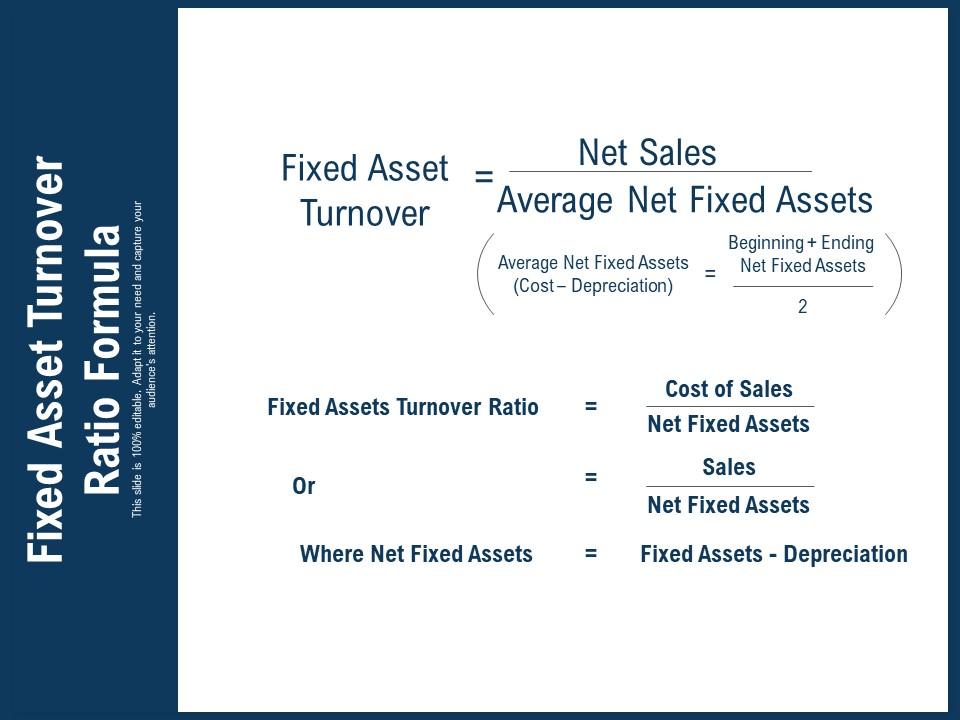

The asset turnover ratio is a financial ratio that measures how much sales a company generates from its assets. Based on the given figures the fixed asset turnover ratio for the year is 951 meaning that for every one dollar invested in fixed assets a return of almost ten dollars is. You can use the asset turnover rate formula to find out how efficiently theyre able to generate.

Asset Turnover Ratio Net Sales Average Total Assets Where Net Sales is the revenue after deducting sales returns discounts and allowances. Only compare asset turnover ratios among companies within the same industry as different industries see different average turnover rates. 122 rows Asset Turnover Ratio Screening as of Q2 of 2022.

Above formula and net sales value as follows. Asset turnover is a measure of how efficiently management is using the assets at its disposal to promote sales. Asset turnover ratio Net sales Average total assets.

74 rows Asset turnover days - breakdown by industry. Asset turnover is a measure of how efficiently a company is using its assets to generate revenue. Best performing Sectors by Asset Turnover Ratio Includes every company within the Sector.

Asset turnover ratio Net sales Average asset value. Starting our Asset Turnover Ratio calculation we first need to adjust sales. Asset Turnover Ratio calculation.

As evident Walmart asset turnover ratio is 25 times which is more than 1. To calculate the ratio in Year 1 well divide Year 1 sales 300m by the average between the Year 0 and Year 1 total asset balances 145m and 156m. Imagine Company A has made 500000 in net sales and has 2000000 in total assets.

Net Sales 75000 5000 70000. Average total assets are. Compare the result to the industry standards and competitors.

The asset turnover ratio is an efficiency ratio that measures a companys ability to generate sales from its assets by comparing net sales with average total assets. Average Total Assets as 140000 and put these value to this. Use asset turnover ratios.

Fixed Asset Turnover Ratio Formula Powerpoint Shapes Powerpoint Slide Deck Template Presentation Visual Aids Slide Ppt

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

No comments for "Asset Turnover Ratio Standard"

Post a Comment